Australian Grain Exports Face Challenges

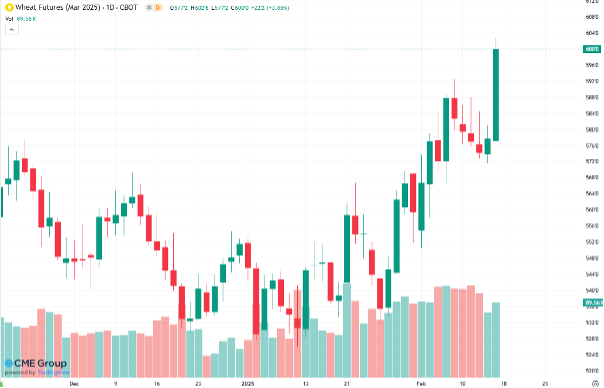

Extreme volatility continues in offshore markets as the world grapples with the lack of Ukrainian supplies while elsewhere in the northern hemisphere, wheat harvest is in full swing. Closer to home Australian exports for the season continue to show good pace in spite of pandemic challenges to supply chain and weather-related setbacks. Current outlooks for a return of La Niña in the spring and the Indian Ocean Dipole status offer hope for a positive year for Australian producers

Ukraine and Northern Hemisphere Harvest

Over the last four weeks there has been ongoing discussion for a food corridor for Ukrainian grain. Currently, about 25% of normal exports are happening by way of land transport through European countries and not through the normal Black Sea shipping lanes. Turkey has led these discussions which include Russia, Ukraine, Egypt and member states of the EU. At the beginning of the war, Ukraine laid water mines in the normal shipping routes for fear Russia would invade the key port area of Odessa. Estimates are as high as 25MMT of wheat is stranded in silos around Odessa. However, de-mining these waterways is a big risk for Ukraine if Russia takes advantage to attack Odessa. It is also worth noting that domestic prices have collapsed in Ukraine putting great pressure on the country’s producers. A truly horrible situation all around.

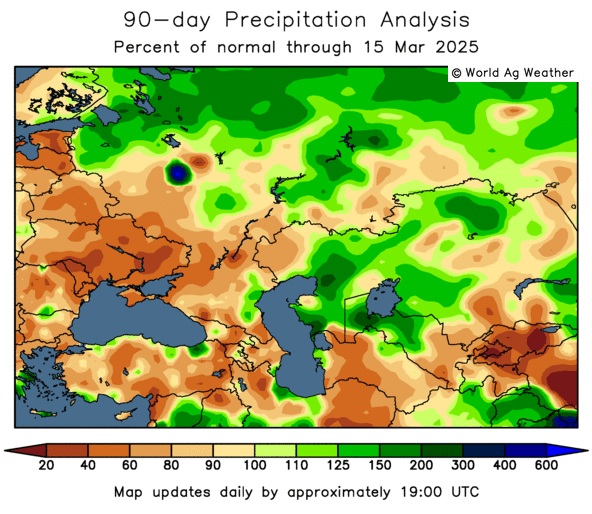

After a tough spring, northern hemisphere farmers in the US and EU are cutting wheat furiously. Yields are down from last season in both the key growing areas of Kansas in the US and France in the EU. Hot and dry weather impacted Kansas production early while France has suffered a tough finish.

The double impact of hope for a Ukraine food corridor and fresh supply arriving, has led to a decrease in global pricing. However, it should be noted that global cash markets have not decreased to the degree of futures markets.

Australian Grain Exports Remain Strong

Between the months of October 2021 and May 2022, ABS data shows that Australia has shipped 18MMT of wheat. At this pace, total season wheat exports should hit the 27MMT mark. An excellent result for producers. Big crops and big demand are what you want!

However, there have been supply chain setbacks due to the pandemic and weather. All states are reporting the difficulty of getting consistent access to road freight. Bouts of COVID are knocking out truck drivers and also impacting locomotive crews. However, reductions in close contact rules have made this easier to navigate.

Recent wet weather in NSW has impacted rail line transport. Grain Central reported in a July 13th article that Pacific National (a major grain hauler in NSW) stated ‘since July 4th, around 43% of grain hauling services have been knocked out by flooding or damage caused by excessive rain’ ( https://www.graincentral.com/news/gunning-derailment-ups-pressure-on-stressed-nsw-network/ ) . At the risk of profanity, presently NSW could do with a little less rain and a little more sunshine.

Weather Outlook Remains Positive

The Bureau of Meteorology updated their 3 month outlook on July 14th. They stated, “the August to October rainfall is likely to be above median for the eastern two-thirds of Australia”. This is largely due to a currently neutral El Nino-southern oscillation which is expected to enter La Niña again in spring. Also, the Indian Ocean Dipole is in negative phase. This phase increases the likelihood of wet weather by way of patterns that sweep southeast across the country from Northern WA and the tropics.

Figure 1 BOM August to October Rainfall Outlook http://www.bom.gov.au/

In summary, the outlook remains positive for Australian producers. For the most part, the Australian weather outlook is supportive with higher likelihood of national rainfall than not. Global grain prices and demand for Australian product remain elevated.

Best of luck to producers over the coming key growing months!