Weather and trade tensions continue to shape ag outlook

Chris Nikolaou, 16 April 2025

Global weather continues to be volatile with improvements in both the US and Russia. The US and China face-off in a second trade war that may be beneficial to both Australian grain and livestock producers. Closer to home there is growing concern over weather outlooks in Southern NSW, Victoria and South Australia.

Northern Hemisphere Wheat

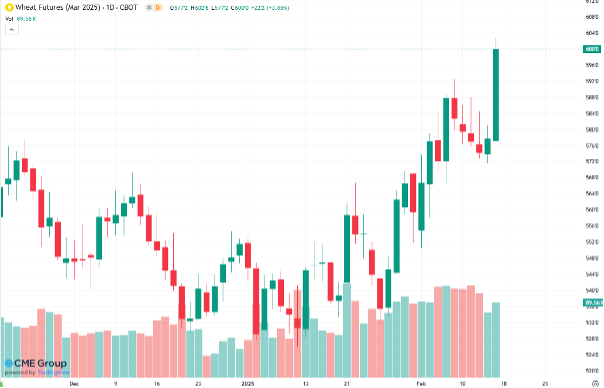

The state of Kansas has suffered from drought for nearly 12 months now. Recent improvements in local weather have seen a downshift in futures pricing and the expectation is for more rainfall. However, this will need to eventuate for the market to take comfort that conditions are improving.

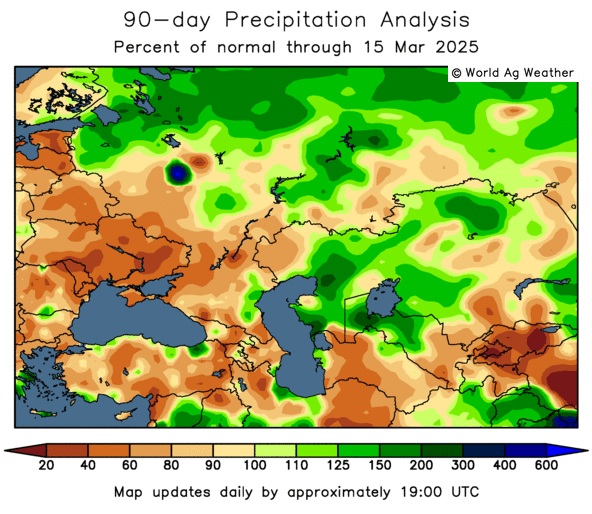

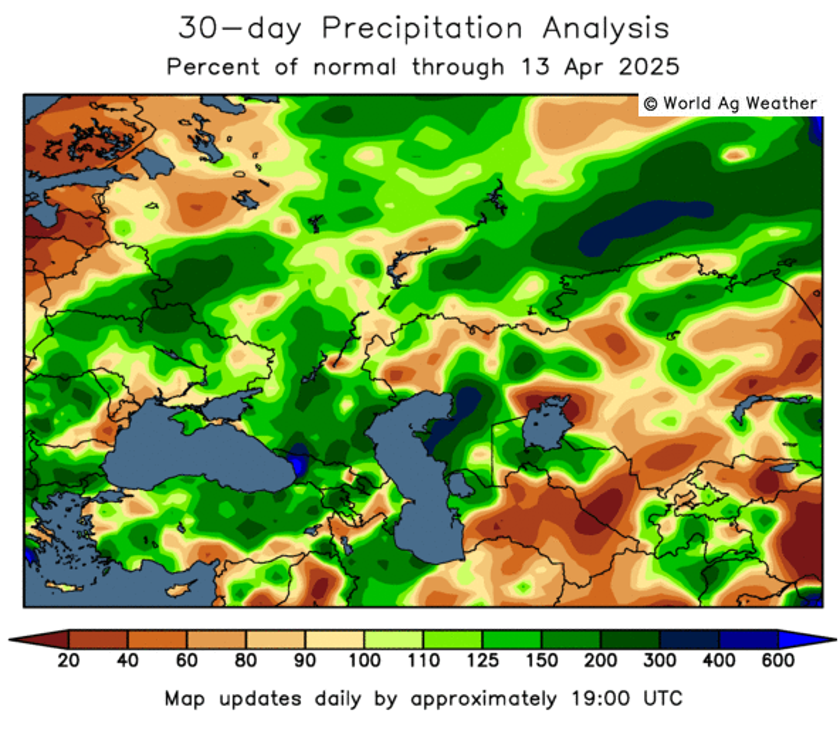

Russia is the world’s largest exporter of wheat. Over the last 10 years and with much government support they have built up to approximately 25% market share of total exports. So goes Russian wheat crop, so goes global pricing. Theirs is another wheat production area that has been under drought conditions for the last year. In late March there was an improvement in rainfall that has stabilised the crop. However, the current outlook is for another dry spell.

The US crop will get made over the next six weeks so nearby weather is more important. However, the Russian crop is later and will be more sensitive to weather over May and June. Although both regions have had recent improvement; they still require monitoring.

The US-China Trade War

Since President Trump’s first term, the US and China have been in an escalating trade war. Although Trump did start this in 2018, many of the tariffs were either kept in place by President Biden or increased. This year with the new administration in place the tariffs have escalated to over 100% in both directions. This effectively cuts off any trade in goods that don’t get an exclusion negotiated.

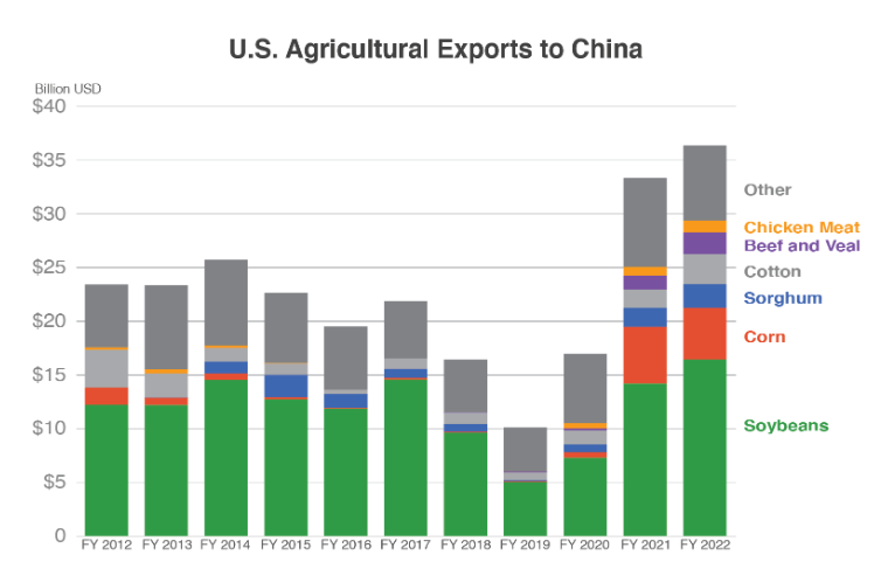

USDA data shows that for the fiscal year 2022; the US exported over $35 billion in agricultural goods to China. The following table is sourced from the USDA website.

This trade flow is made up of $16.4B in soybeans used for animal feed, largely in pork production. $7B in corn and other feed grains for poultry and pork production. $2.7B in cotton. $2.1B in beef and beef products. $1.1B in pork. Poultry and poultry products accounted for $1.1B in exports and $750M in dairy products. With tariffs now in place and no exclusion on the horizon, market participants are expecting US ag exports to China to decrease dramatically. This is good for Australian primary producers as much of these products will need to be sourced elsewhere by Chinese buyers. The barley and sorghum markets have already seen strong China buying in the first quarter of this year.

It is worth noting, this is all with the backdrop of an ongoing conflict in Ukraine where both sides have dug in, frustrating the new US administration’s attempts to broker a peace deal.

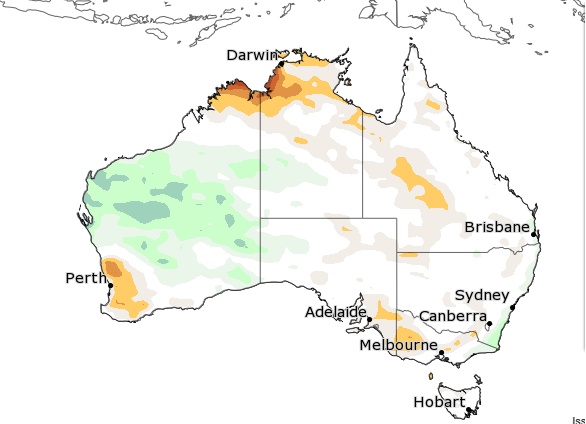

Australia enters the sowing period

The south east of Australia has been doing it tough over the last twelve months. In particular, Eastern South Australia and Western Victoria. Both regions finished the 2024 production campaign with lower than average yields due to poor rainfall. In fact, some parts of SA had the worst season in over 20 years. Fast forward 6 months and the local dry is now spreading with much of SA, VIC and southern NSW in extremely dry conditions. Rainfall is needed but the current outlook is not promising.

The Bureau of Meteorology, in their update dated April 10th, called for a drier than normal April and May before normalising in June and turning over wet.

We hope for a more positive start to the season than this for all producers currently facing poor conditions.

What does it mean?

Northern hemisphere major wheat producers are experiencing volatile conditions as their season progresses which may lead to changes in market prices as we go along. The US-China trade war has escalated beyond any point in the last seven years and will likely offer opportunities for Australian producers to increase their market share of Chinese buying across a range of primary products. Finally, local weather is challenging growers’ patience in the South East of the country. It is imperative we see an improvement in weather in this part of the country. Overall, politics and weather continue to create volatility for grain and oilseed markets. The former will likely offer opportunities for Australian producers while the latter is up to Mother Nature.