Is this the season to pool your grain?

6 January 2025

With market volatility likely to continue throughout 2025, a current low-price market and a large Aussie crop now almost completely in the bin, could this be the season to pool a portion of your grain?

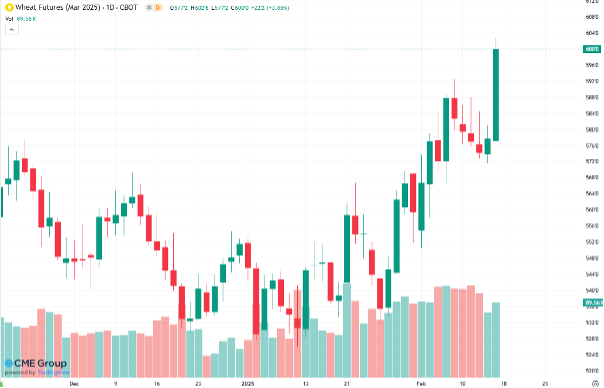

Throughout 2024, Australian growers saw a trend of general bearishness in the grain markets, with brief periods of extreme volatility.

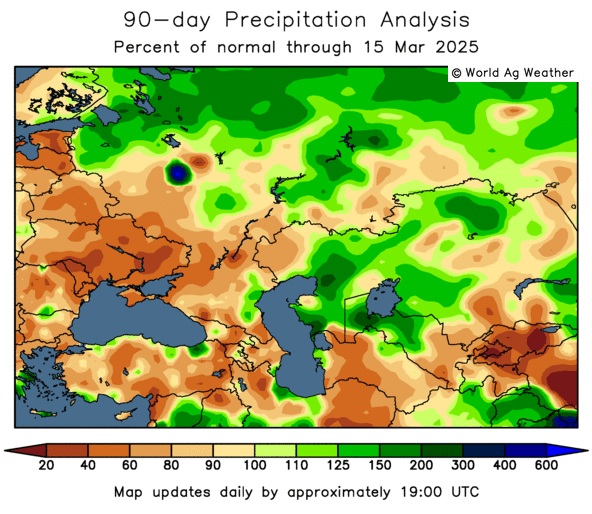

Over the month of May, for example, the wheat market rallied by 20% as it became apparent the Russian crop was in decline.

However, Advantage Grain General Manager, Chris Nikolaou, says 2025 is shaping up to be better for growers.

“A shortfall in oilseeds in Europe has boosted canola prices over the last three months,” he said.

“Ongoing dryness in Mexico and recent dryness in Argentina, along with Russia decreasing its export quota for 2025, may provide the turnaround grain markets need in 2025.

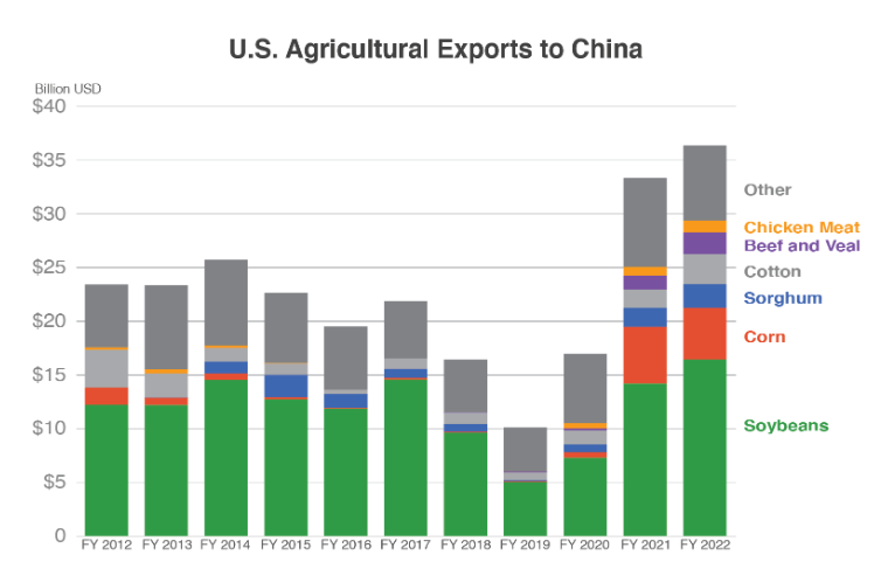

“However, it is difficult to predict the incoming US administration and what their policies will be towards the Ukraine war and with tariffs on China.

“We see green shoots, a turnaround from the current low prices, but foresee continued volatility due to politics and weather.”

Locally, the current pricing reflects the reality of a national wheat crop of 32.5 million metric tonnes coming to market over the harvest period.

The lower AUD is making exports competitive and a decreased Russian export quota for the first half of this year will limit the competition for Australian grain exports.

It is also expected that there will be strong demand for Australian wheat, which could bode well for pricing over the coming months.

The combination of these domestic and international market drivers could provide perfect conditions for long term grain sales strategies that grain pools provide, to extract more value from the 2024 harvest.

Chris said Advantage Grain’s best price averaging sales programs are designed for this type of market volatility.

“We have seen favourable results over the past few years in a similar market environment, particularly with downgraded grain,” he said.

“We have a team in the market every day searching for the best prices and intricately following market drivers so growers can see the benefits of the potential increased return, without the stress and 24/7 market vigilance involved.

“The pool acts like a managed fund. We pool all the grain together, like a managed fund pools money, then manage that grain portfolio in its entirety, giving farmers access to larger markets, managing the relationships with buyers, both domestic and export, providing counter party insurance and more.

“We are essentially another business function that growers can outsource to an expert, the same way they use an agronomist to look after the health of their grain, or a mechanic to fix their machinery.

“We look after the grain marketing and all the administration work that comes with it, and we pay on time, every time, so growers can get back to farming, knowing their grain marketing is being taken care of.”

Advantage Grain’s wheat, barley and canola pools sell an equal portion of grain over a two, four, five or 10-month time period and provide the best price average return back to farmers who pool with them.

All programs offer three payment options; advance, monthly and deferred, and are closing for transfers on Friday 24 January 2025.

For more information on the Advantage Grain programs, or to see their historical returns, you can visit their website advantagegrain.com.au or call 1300 245 586.

ENDS

Media contact

Stephanie Buller

E: s.buller@advantagegrain.com.au

M: 0447486934