Grain Market outlook for 2025

Chris Nikolaou, 6 January 2025

For the majority of 2024, agricultural markets experienced a bearish market globally. However, there may be change on the horizon. Russian exports have peaked for the current season and local estimates are for lower production in the upcoming season. A lower Australian Dollar is assisting by making our grain values more affordable to off-shore buyers. Mexico continues to experience drought in key corn growing regions and Argentina has turned over to a dry spell to start the new year.

Australian Production finishes strong outside the southern states

QLD, NSW and WA have outperformed expectations this year after periods of dryness and frost events. However, VIC and, in particular, SA have not been so lucky. Growers are reporting in some parts of SA they received their lowest in-season rainfall in 100 years! This poor weather in the south has taken its toll, and production is down almost 50% on last season. However, the national wheat production figure is expected to come in at a respectable 32.5 million metric tonne (MMT) for wheat, buoyed by strong production in the book-ends of WA, NSW and QLD.

Local pricing has been soft on account of a decent overall national production figure. However, Australia is currently priced competitively and should see strong demand for exports.

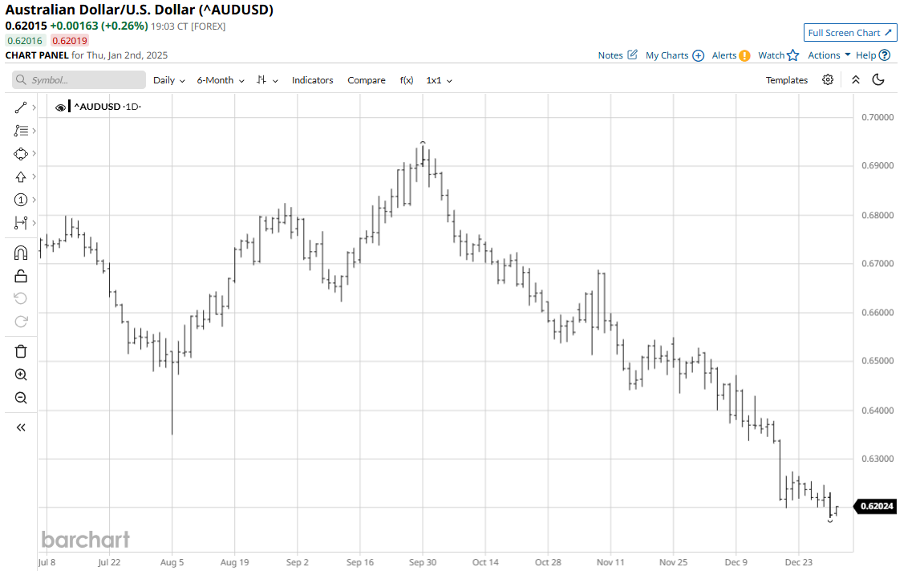

Australian Dollar drops

Since the end of September, the AUD has fallen over 10%. This is due to two reasons. One, expectations for the United States to increase their budget deficit with the planned tax cuts by the incoming administration. Also, a tariff war would weigh heavily on the Chinese economy who is Australia’s largest trading partner. Therefore, the outlook for the AUD was significantly reduced once the market digested the impacts of the policies after the US election. We expect the trend of a lower AUD will continue if these policies come to fruition.

This makes Australian ag products cheaper to overseas buyers and we expect to see strong demand for Australian, wheat, barley and canola as a consequence.

Mexico endures two year drought

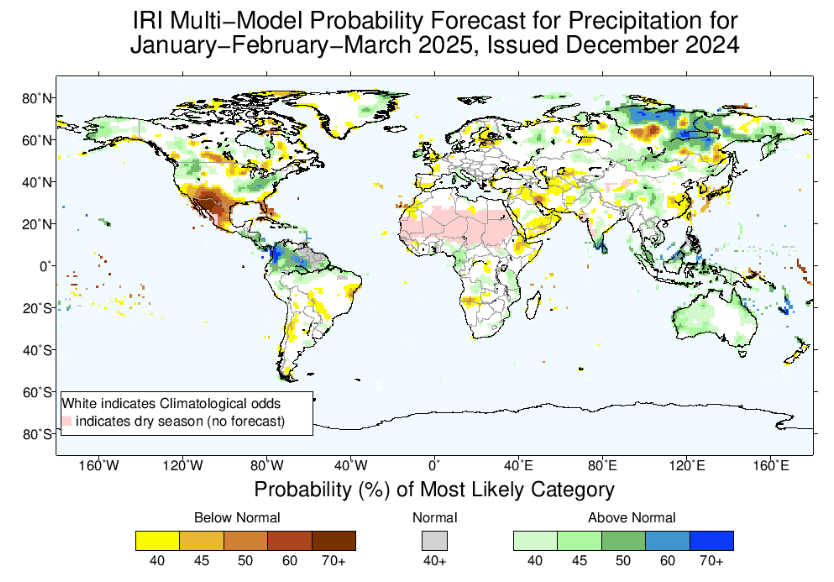

The current Mexican drought commenced in late 2022 leading to national water usage restrictions. They experienced a short term rainfall reprieve in the 3rd quarter of 2024 but the dry is now building again. Local production of corn has been reduced, and imports were up 5MMT in 2024. Currently, long range models are calling for this weather pattern to continue and for the drought to worsen during 2025.

There is also a risk that this drought “moves” north into the southern states of the United States and impacts US wheat production in the northern hemisphere spring.

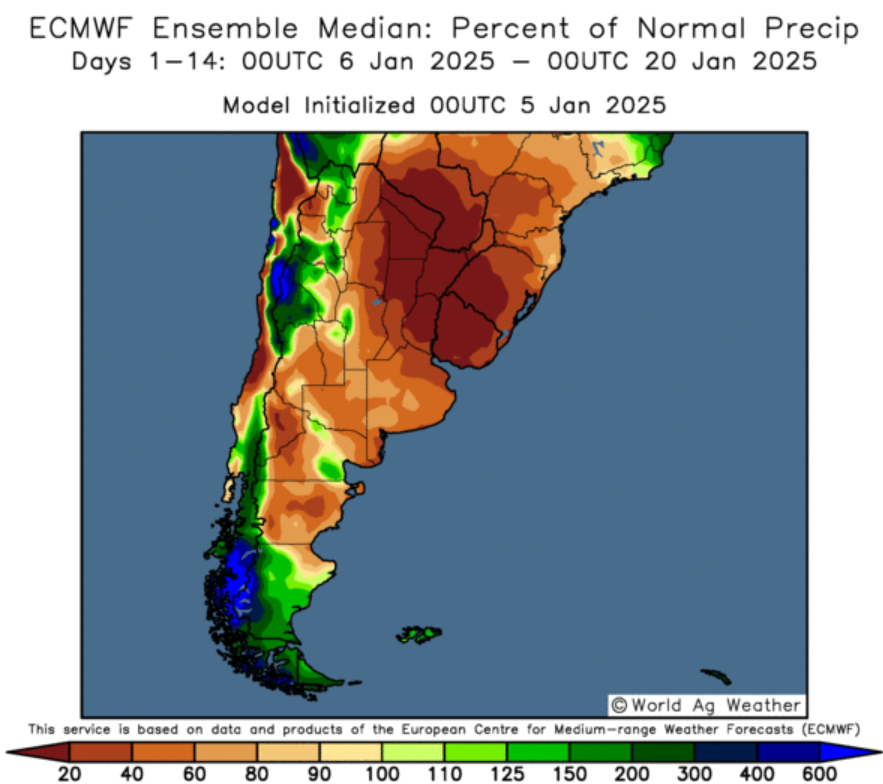

South American production faces second production threat this season

Brazil experienced one of its driest Septembers on record in 2024. However, when the monsoon weather commenced in October, the skies opened and never really closed. In the end, 2024 ended with the expectation that South America would have a banner oilseed and corn crop which has cast a bearish shadow over ag markets. But over the last fortnight, Argentina has experienced drier than normal weather. As of the date of writing, their forecast is for an extremely dry two week outlook. Although soil moisture is good, 4 weeks of continuous dry weather will begin to take its toll. Also, the dry outlook is spreading into southern Brazil. If this weather pattern continues into the latter half of January, markets will rally to price the smaller than initially thought South American supplies. This would have knock on effects for wheat, barley and canola.

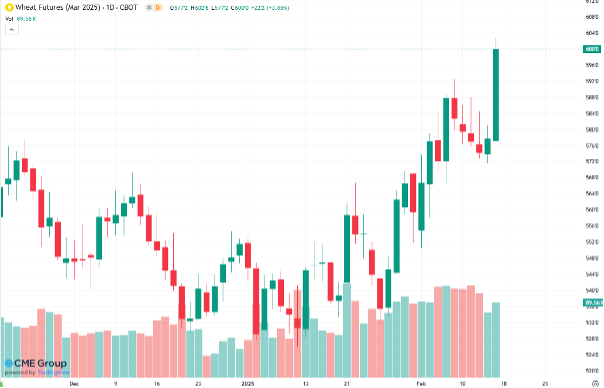

Russia sets restrictive wheat export quota for the First half of 2025

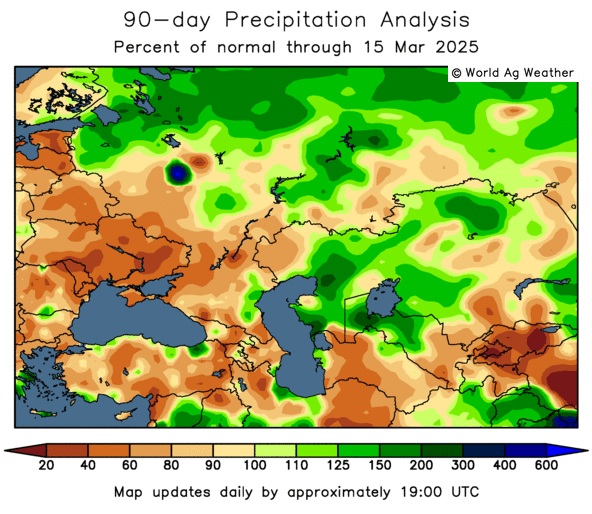

2024 saw challenging weather for Russian wheat production. A dry period earlier in the year cut current season production back to approximately 83MMT. However, some timely rains helped to avert disaster. For the balance of the year, dryness continued and the sowing campaign is believed to have been down 3% from last year due to this. Local commentators are saying that this coming year’s wheat crop could be in the worst condition in 10 years.

Where there is smoke there is fire.

In early December, the Russian authorities decreased their allowed export quota to 11MMT for the period February through June of 2025. This is down 10MMT from 2024 and is very good for Australian wheat demand over what is a key exporting period for us. It is also worth noting that monitoring Russian spring weather will be important from March forward as any further weather stress will compound what has occurred over the last 12 months.

What does it all mean?

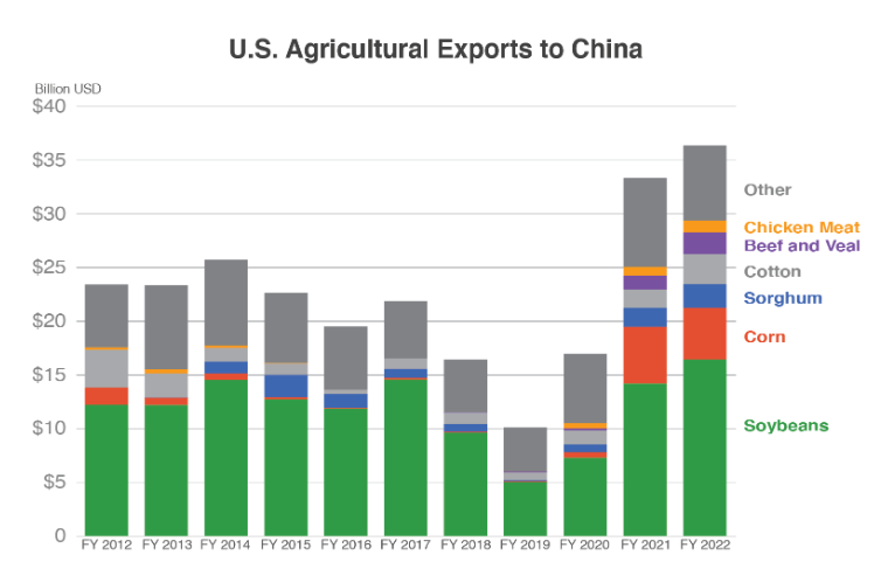

As usual, grain market volatility will continue. Weather will play the major hand but also a heightened geopolitical landscape including war in the Black Sea and an incoming administration in the US that could commence a trade war with the world’s second largest economy.

Advantage Grain offers growers a professionally managed grain marketing service. We have a team of pool managers in the market every single day monitoring both global and local markets in the endeavour to return the best possible grain pricing to growers.

We do the grain marketing so you can focus on the grain production.

For more information on Advantage Grain’s best price averaging grain pools, visit advantagegrain.com.au or speak to the team on the details below.

QLD and NSW: Jack Craig 0474 845 782

SA and VIC: David Long on 0427 012 273 or David Evans on 0437 176 280