Continued Turbulence in Global Commodity and Capital Markets

March 2023 saw continued turbulence in global commodity and capital markets. Ongoing economic uncertainty, geopolitical tensions, and concerns over inflation and interest rates were among the drivers of market volatility. A steady stream of headlines relating to global weather and crop conditions, the continuing flow of low-cost Black Sea origin grain into the global market and light at the end of the tunnel after a three year Australian barley export tariff into China saw agricultural markets respond accordingly.

Financial Markets

Confidence in the US banking sector took a hit during March with both Credit Suisse and Silicon Valley Bank undergoing significant restructuring to prevent further broader issues. Markets responded by reducing risk with crude oil, gas and agricultural markets not immune to the sell-down. This flowed through to domestic oilseed pricing. However, energy and oilseed markets were given a much-needed boost towards the end of March after OPEC unexpectedly announced a cut to oil production by more than one million barrels per day.

Weather & Crop Conditions

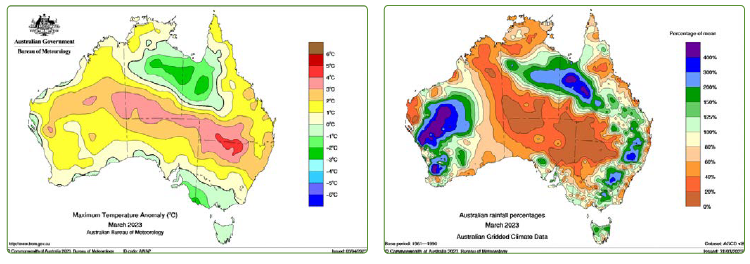

Rainfall across grain growing regions in March was pleasing, particularly after the ominous forecasts showing a return to a “Neutral” phase ENSO and a 50% chance of El Nino in later 2023. Temperatures through March were slightly above long-term averages. During the latter half of the month, heatwaves led to record-breaking temperatures at numerous stations in New South Wales, Victoria, parts of Pastoral South Australia, and south-eastern Queensland.

The steady rain across the country prompted a trickle of grower selling during March putting pressure on domestic markets.

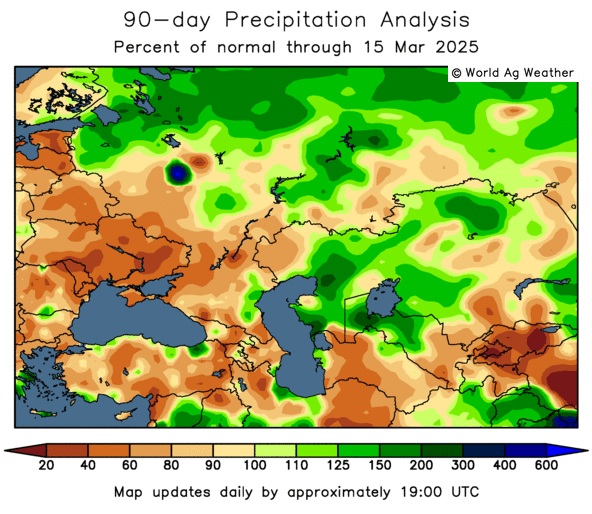

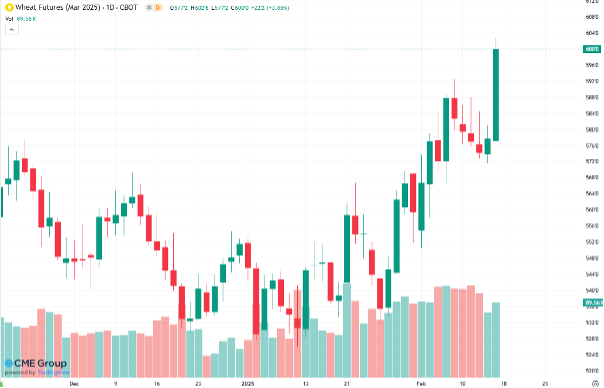

Further abroad, conditions in major US hard red winter production areas in Kansas, Texas and Oklahoma continue to go backward. The latest USDA crop progress report has only 27% of the crop in good-excellent condition, which is a record low for April, suggesting poor yield potential without a dramatic improvement in weather.

Global Pricing Complex

Russia’s record wheat crop continues to flow into the global marketplace at a rapid pace and highly competitive values. The UN’s negotiated Grain Corridor was extended by another 60 days allowing Black Sea exports to continue unhindered. Russian March exports are estimated at 4.5MMT, another monthly record, and are dominating major global tenders setting the tone for global values and putting pressure on Australia to remain competitive.

The Australian shipping stem continues to be added to, albeit at a slower rate as non-traditional buyers further abroad in the Middle East and North Africa have switched back to cheaper Black Sea suppliers where possible. Traditional Asian export destinations continue to tick over.

To further complicate global pricing, Russian officials recently indicated the need for Russian exporters to loosely adhere to a floor price for wheat sales. As a result, a number of large multinational grain companies made the decision to cease upcountry Russian operations. The threat of Russian political intervention in the markets is ever present and adds a layer of risk to Black Sea exports. Luckily, Australia is a transparent and good faith actor in global markets, which buyers appreciate!

Promising News for Australian Barley

Encouraging developments have come to light for Australian barley growers and the broader Australian feed grain market.

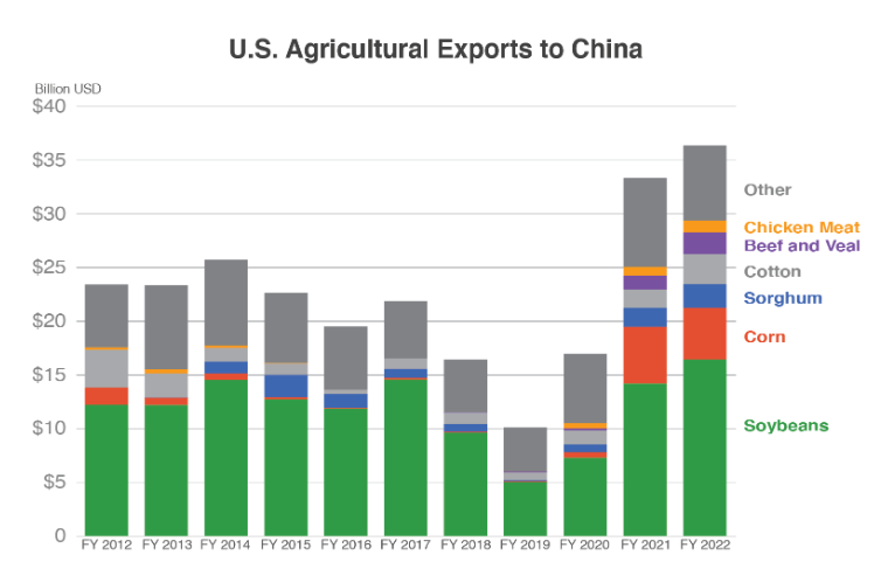

The Australian federal government has agreed to temporarily halt its appeal to the World Trade Organization (WTO) regarding the Chinese government’s 80% tariffs on Australian barley. This comes just before the WTO was set to announce its finding on the matter and in return, China has committed to an “expedited review” of the tariffs within the next three months.

China has historically been the most important buyer of Australian barley, accounting for between 50-85% of Australian barley export trade between 2014-2020. Since implementation of the tariff, the main destination for Australian barley has been Saudi Arabia where we have a freight disadvantage from other origins. Australian barley growers would benefit immensely from our freight advantage into China if free trade can resume.

What does this mean for local grain markets?

As we can see, grain markets face cross winds from political events, the global financial outlook and from a fundamental point of view. One thing is for certain, volatility is set to continue. Amongst this backdrop, Advantage will continue to maintain the program mandate of low risk selling over a pre-set period of time. In the meantime, we wish all Australian producers a safe and productive sowing period for the upcoming program.