Food Security Takes Centre Stage

The violence in Ukraine continues to dominate global markets as both sides settle into what could be a drawn-out conflict. President Zelensky continues to embody the grit of the Ukrainian nation while President Putin seems determined to annex portions of the country in both the east and south. Dryness in the Southern Plaines of the United States further threatens the outlook for wheat supplies in the 2022/23 season while India emerges as an unlikely exporter of wheat. High commodity prices have now become a political touch stone in both the east and the west with Sri Lankans taking to the streets to protest lack of food and fuel availability.

Ukraine Conflict

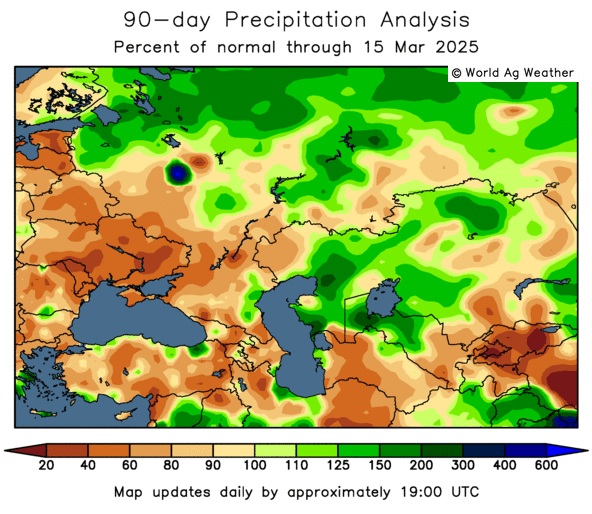

Over the last six weeks, the world has watched in horror as the Ukrainian conflict continues. Russian troops have retreated from the north of the country and their ambitions to take Kyiv. It appears the Russian military is now focused on the southeastern portions of the country which is wealthy in commodities including natural gas, coal and agricultural products. Bulk ocean exports have been replaced with road and rail exports to neighbouring countries such as Poland, Slovakia, Hungry and Romania. Albeit, at about 10% of the pre-conflict export pace. It is also worth noting that the Ukrainian government is now offering a farmer support by purchasing grain produce from local producers. As we have said before, we hope for a speedy diplomatic resolution to the conflict in Ukraine.

Figure 1: Ukraine replaces seaborn exports with land-based exports into neighbouring countries

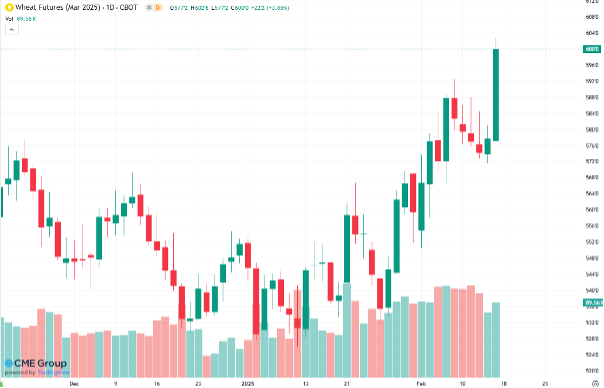

US Wheat Outlook

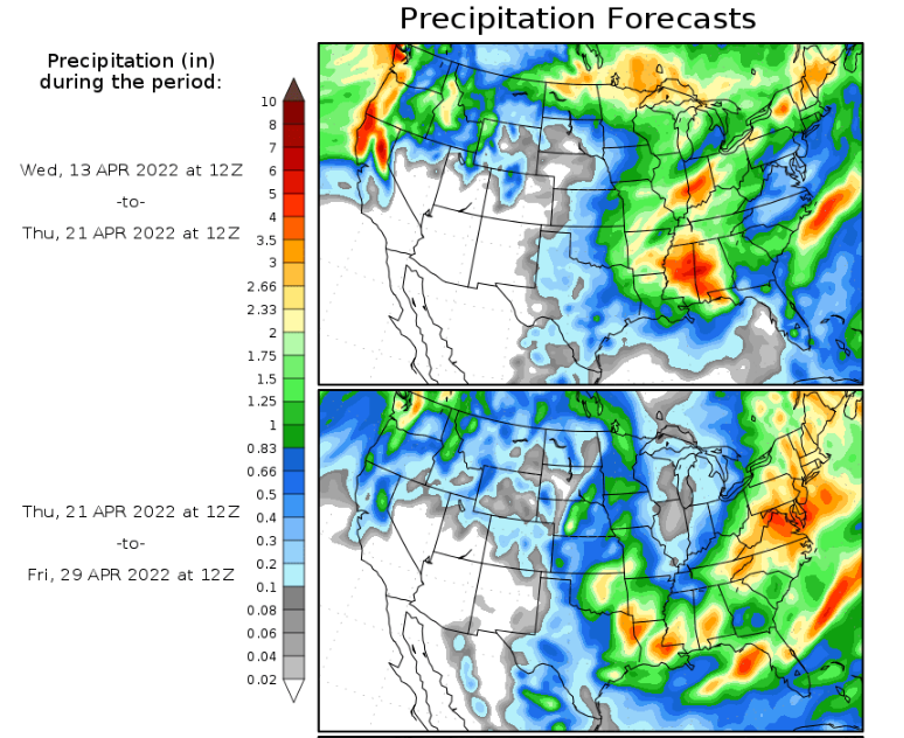

On April 5th, the weekly wheat crop condition ratings re-commenced after the winter dormancy period. Overall, US winter wheat was rated 30% good to excellent and 36% poor to very poor. This the worst ranking in decades and the market responded accordingly with futures up 10% since then. There is currently rain forecast for hardest hit Texas, Oklahoma, Kansas, and Nebraska. However, it is in the back-end of the model which we have all had frustrations with in the past.

Figure 2 http://wxmaps.org/outlooks.php

Food Security

This week the IMF World Bank stated that they are concerned with food security and made an appeal to exporting nations to not restrict food or fertiliser exports. High agricultural commodity prices are having a severe impact on poorer nations. This week we saw Sri Lanka default on government bond payments and state they were keeping the funds for the purchase of food and fuel instead. This is following weeks of protests in the city of Colombo aimed at the president of the nation.

Closer to Home

Australian exports of wheat, barley and canola continue to advance at record pace offering good markets for grain across the country. With the Ukraine crises likely to continue longer than originally believed, it is expected this export pace will continue through the entirety of the season. Over the coming months, Australian producers will begin the new season with sowing. Much of the country holds good moisture with WA receiving rain in recent weeks. However, not all areas are as positive with farmers in Eastern SA, Western and Central Vic looking for a drink.