Market volatility goes both ways

Chris Nikolaou 17 June 2024

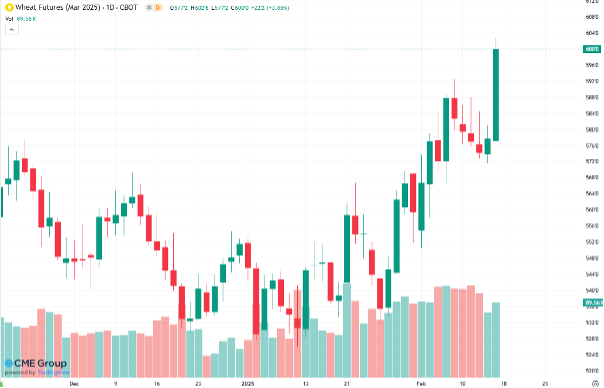

Over the last four weeks, global grain markets have featured an extreme level of volatility due to events in Russia and Turkey. Last week’s USDA update of global supply and demand statistics has confirmed the upcoming year will be globally tight due to an extremely dry spring in Russia. However, Turkish authorities took the decision to throw cold water on the global rally by announcing a wheat import ban. Closer to home, WA has received much needed rains while calls for La Nina continue but extend further into the future.

The Russian motherland

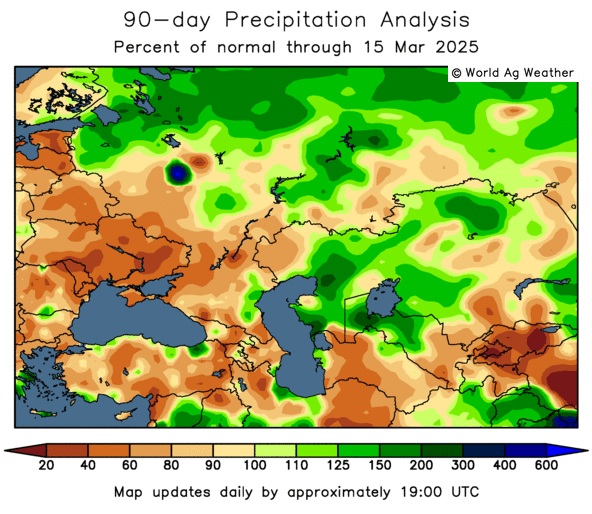

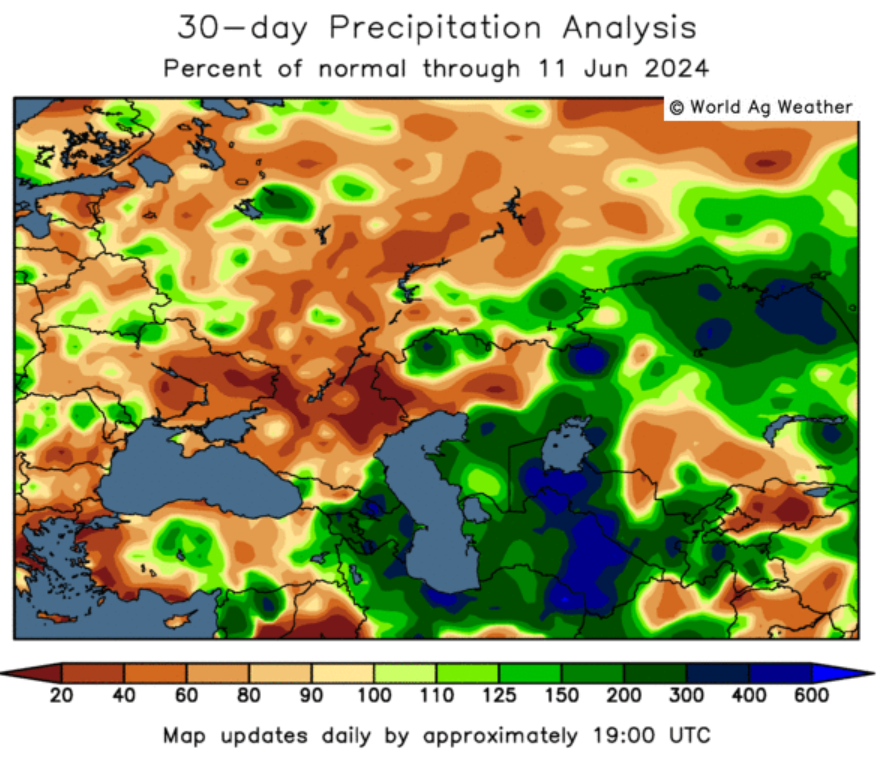

Over the months of April and May, the Russian wheat growing belt experienced its driest spring in over 20 years.

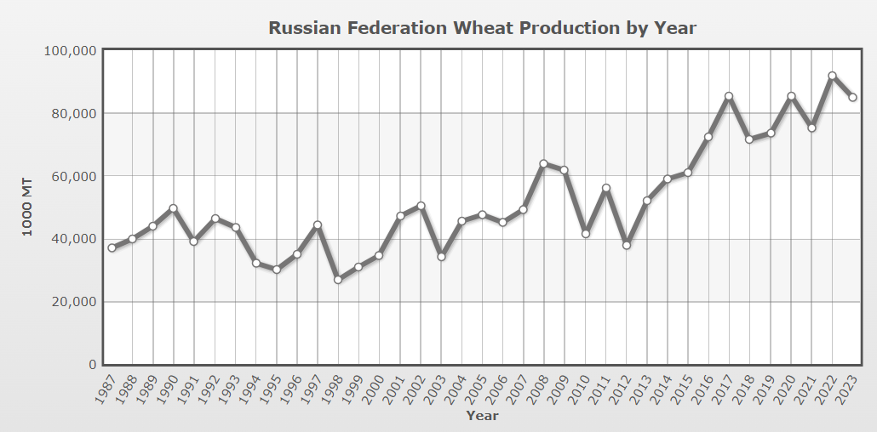

The impact has been real with the USDA calling for a reduction of overall wheat production in the nation to 83 million metric tonnes (MMT). This is down 8.5MMT from last season’s crop and is expected to be downgraded further in upcoming reports on account of the current hot and dry weather. This same weather pattern has impacted Ukrainian production which was decreased to 19.5MMT versus last season at 23.5MMT. Global markets responded accordingly over the last two months with an aggressive rally in both futures and cash markets.

Turkey to the rescue (of their own)

“I hold the world but as the world, Gratiano, A stage where every man must play a part” So says Antonio to Gratiano in The Merchant of Venice. Last week Turkish authorities “decided to play their part” through a ban of wheat imports from June 21st through to mid-October. They went on to state the action would “prevent our producers from being affected by price decreases due to supply density during the harvest period, to meet the raw material supply required for our exports from domestic production, and to ensure market stability in favor of producers”. Turkey imports an average of 9MMT of wheat per year so this came as a strong blow to pricing. It is expected Turkey will still come to market for their normal requirements, but it will be in the back end of the marketing season. However, in the near term European and Black Sea producers and exporters are looking for import market opportunities for their freshly harvested production.

Australian focus

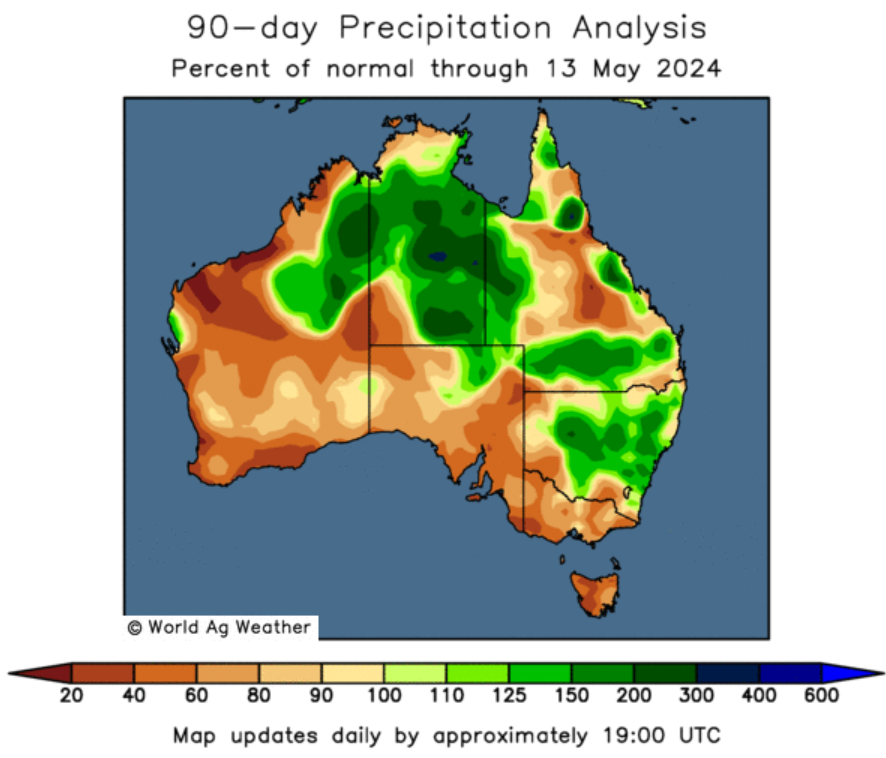

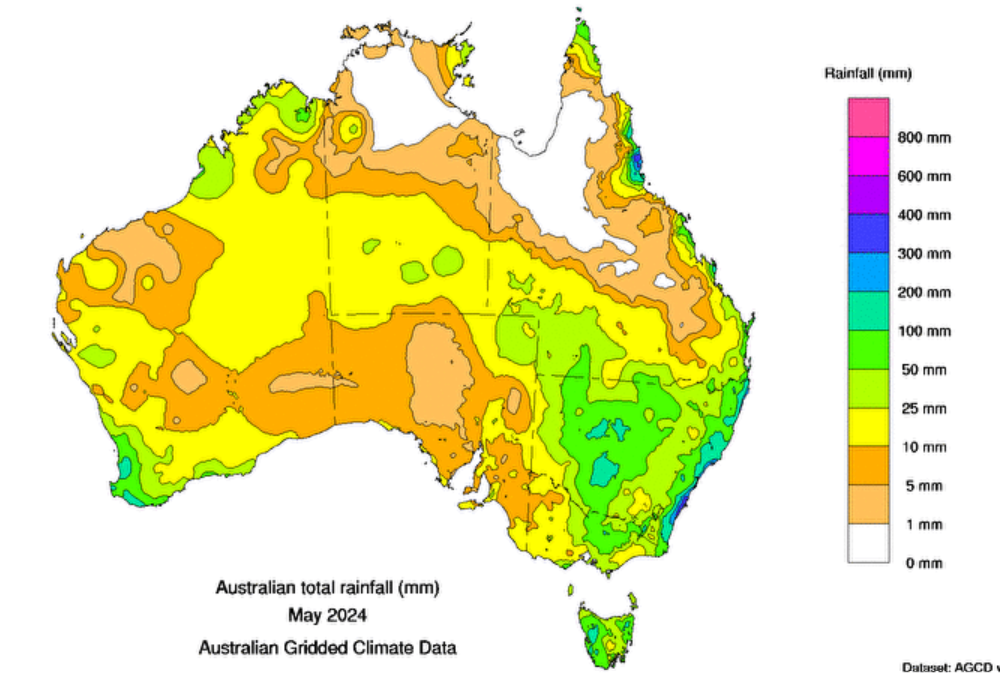

WA growers have faced adversity with extremely dry conditions until the last fortnight where the season has finally broken with good rains. NSW and QLD have been enjoying improving conditions while SA and western VIC producers still await their break.

Canola Update

The canola market has experienced a marked improvement of values since earlier in the year. Of all the grain and oilseeds balance sheets, canola will remain the tightest for 2024 with improved consumption in the EU, reduction of planted acres in Australia and a turn-around in global vegetable oil pricing expected for the second half of 2024. Canada has recently received widespread rainfall. However, there is not the room in the market for a supply threat later in their growing season.

Summary

Global grain and oilseed markets continue to be volatile but the medium to longer term outlook is positive for Australian producers providing we can get the right weather.

The Advantage 5 program has recently finished strongly with the May rally in prices. Growers in both the 4 and 10 programs will benefit from improved pricing conditions as well. Overall, we are pleased to see improving seasonal conditions in WA and look forward to the season breaking for SA and VIC producers.