World wheat markets rally on the threat of Russian drought

Chris Nikolaou 16 May 2024

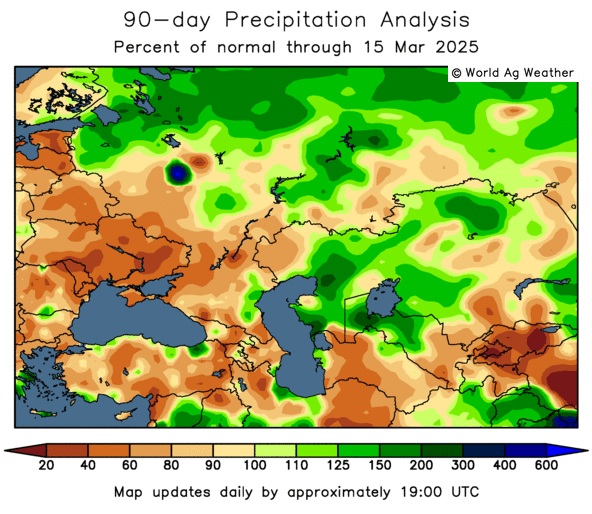

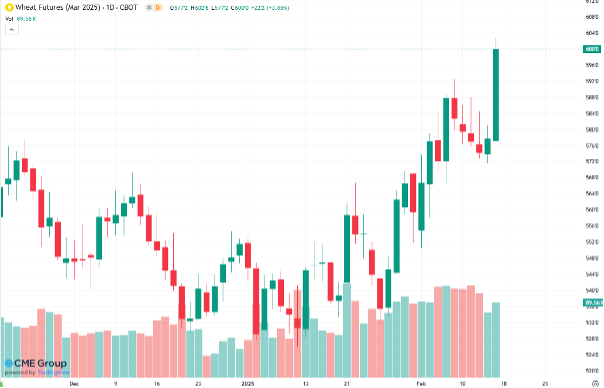

Over the last four weeks we have seen an AUD $50 per metric tonne rise in wheat prices. This has largely been driven by a very dry March and April in the central growing belt of Russia. In the United States, ongoing wet weather threatens the timely plant of corn. Here is Australia, we are looking for rain to replenish soil moisture in Victoria, South Australian and West Australia.

The Russian bear bulls up wheat

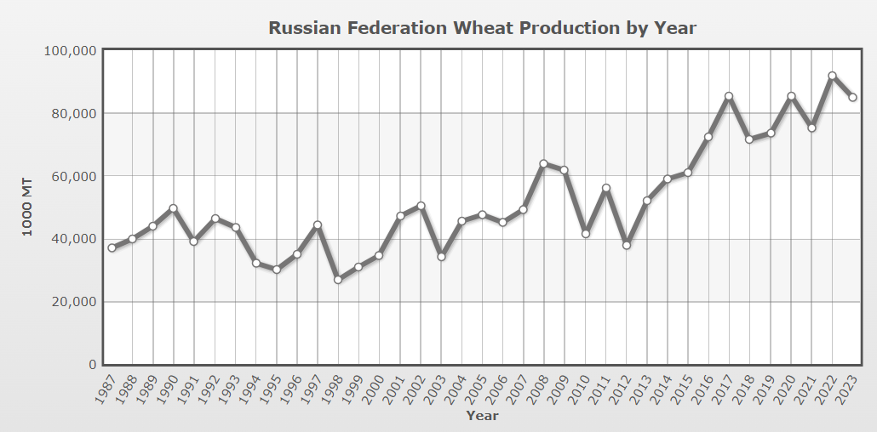

Last season Russia produced approximately 90 million metric tonne (MMT) of wheat. 65% of this production is winter wheat and 35% is spring wheat. This year’s winter wheat has faced the driest April-May in 20 years. Last Friday, the USDA updated their production estimate and pulled it back to 88MMT. It now appears that further cuts will be necessary as May is turning out to be another dry month for core growing regions. Many private analysts are now at 85MMT or less. This is meaningful due to the large market share of global wheat trade Russia holds. They are the largest exporter of wheat and hold approximately 25% of the global ocean traded wheat market. They were also consistently the lowest price exporter prior to the war in Ukraine. To date, Russian producers have had the benefit of cooler than normal weather. Frost events have occurred, but they have been able to avoid the large drawdowns that occur during dry and hot periods. It is estimated that every week this pattern stays in place Russia loses 1MMT of wheat production. This number would accelerate if it were to turn over hot at any stage as well.

Overall, Russia has had a run of a number of seasons without a severe production issue. Some of this is due to government support, and some is due to the conversion to capitalism and incentivising producers to adopt better farming practices. However, a run of good luck doesn’t hurt either.

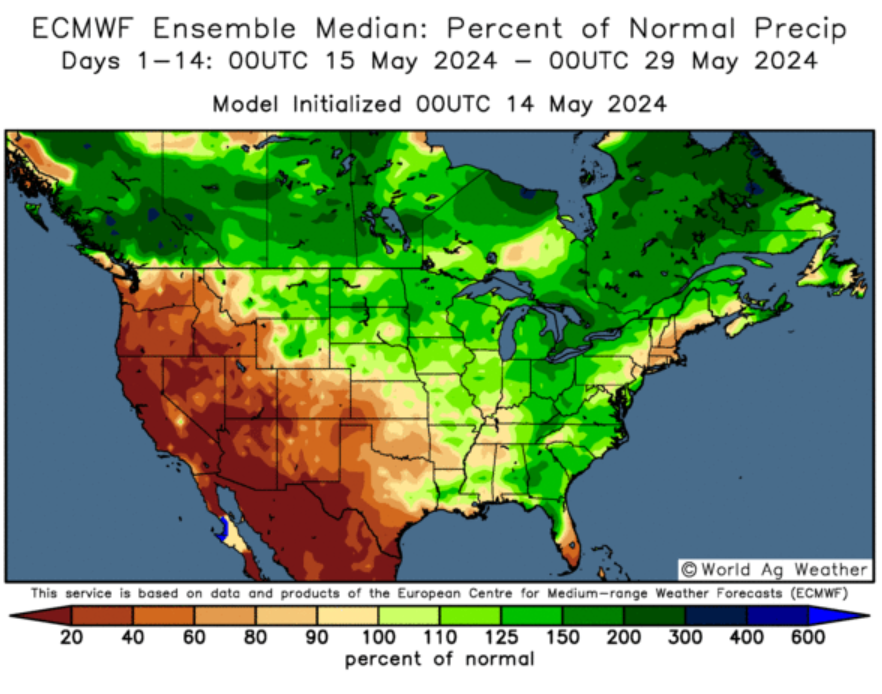

Planting delay in the United States

During sowing in the United States, government officials release a weekly crop progress report. On Monday, May 12th the report stated that corn was 49% planted vs a 10 year average of 60% complete. The delays are due to ongoing wet weather that is preventing folks from getting into the paddock. This wet and stormy weather is expected to continue for the month of May in the main corn growing regions of the Midwest. Unfortunately, this will have a negative impact for two reasons. Later planted corn will suffer a yield loss and producers will switch from corn to beans. Although this happens on the margin, it will be supportive to corn values which will be supportive to all feed grains and lower qualities of wheat.

Australia

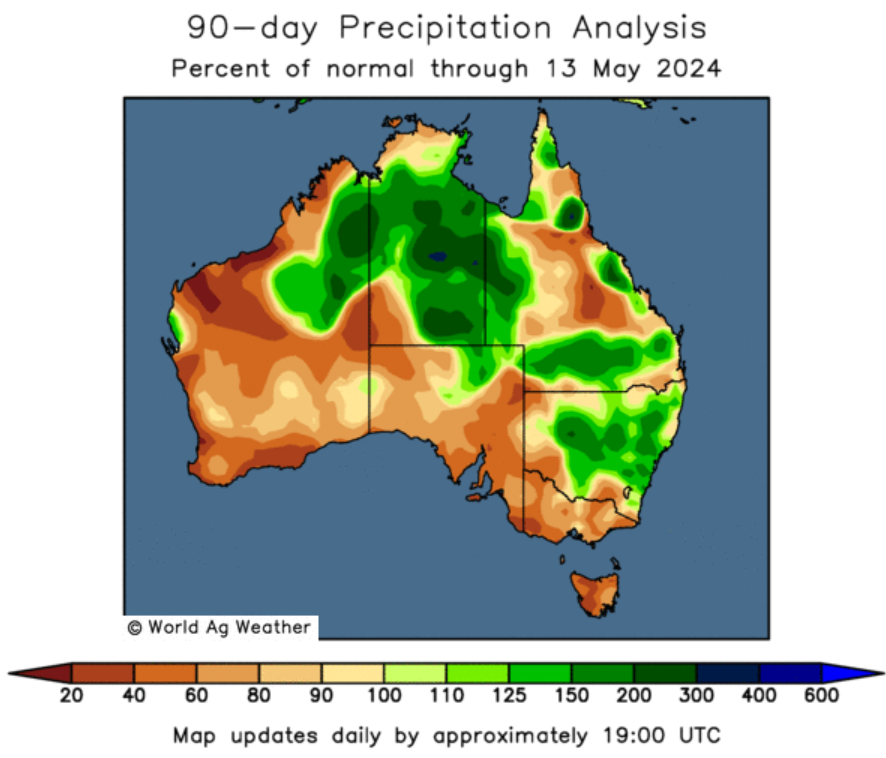

In Australia, we have the opposite problem for much of the country. Queensland and New South Wales have seen excellent rainfall over the last 3 months. However, Victoria, South Australia and Western Australia have not been so fortunate.

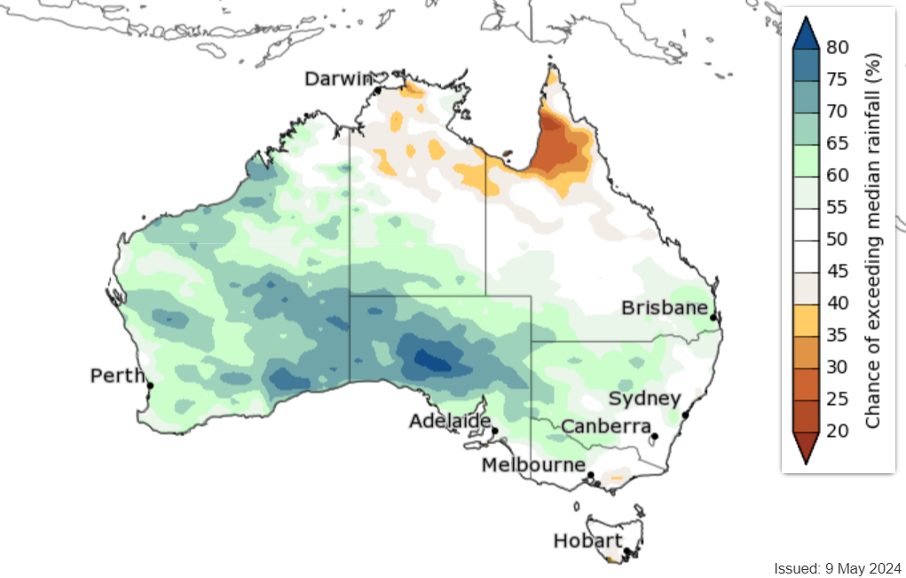

On May 9th, the Bureau of Meteorology released their long-term forecast. For the first time in months, they called for a return to “average to above average” rainfall from June forward. This would be timely and a bonus for growers in the impacted areas. It is worth noting that forward estimates continue to show a return to La Nina conditions by late winter.

Summary

Russian weather is front of mind for global wheat markets and has the ability to make or break prices over the next eight weeks as their winter wheats mature towards harvest under unusually dry conditions. US corn production is off to a poor start and acres are likely to be switched to oilseeds if the wet weather continues. Closer to home, many regions of the country have suffered a dry autumn and are in need of rainfall to recharge soil moisture. Although the BOM and other meteorological services are calling for conditions to improve – they never make it easy and straight forward!