Piecing together the puzzle of Aussie grain prices

Rowan Fessey 16 August 2024

WASDE

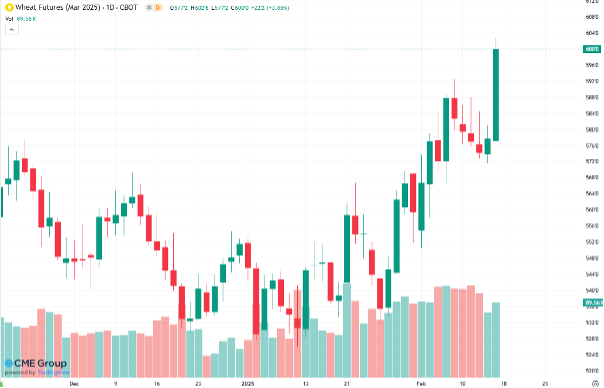

The August USDA report unveiled a few US centric surprises and some expected changes across the globe.

Corn and wheat numbers were supportive of prices with US corn cut by 800,000 acres. However, this was offset by a record estimated yield at 183 bu/acre to slightly increase overall production on the last report.

European corn production was reduced by 3.5 million tonnes with the collective EU and Black sea production reduced by 8.75 million tonnes versus last year. EU corn consumption was reduced 2.5 million tonnes overall with a shift to wheat feeding expected due to a low quality downgraded EU wheat crop on the horizon that will make its way into feed rations.

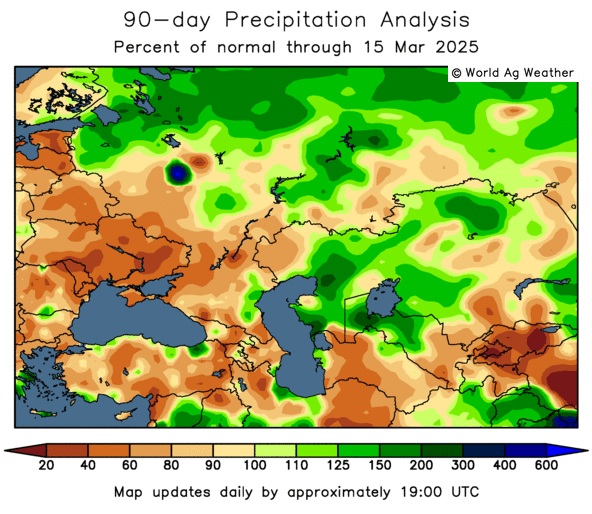

The USDA increased wheat production numbers across Australia, Ukraine and Kazakstan and made cuts to the US and Europe. Overall global wheat carry out is set to decrease slightly with increases in livestock feeding cutting into stocks.

Wheat Quality

French growers have endured the fourth wettest spring on record with rainfall up to 45% more than the 10 year average dating back to 1991, according to Meteo France. Sunshine throughout the European spring was estimated at a 20% sunshine deficit across France vs seasonal averages, limiting photosynthesis and crop development. Recent crop ratings from the French Agrimer put the French crop at 50% good to excellent, with ongoing wet harvesting conditions making progress slow. Quality levels are highly varied by region, however the national average for protein is reported to be similar to 2023.

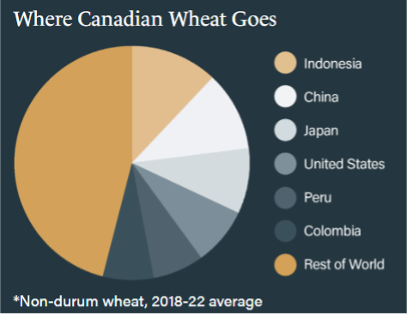

Canadian wheat growers are working through a hot and dry finish to what was a promising crop. Conditions have tumbled in recent weeks with crop ratings falling through late July. A cooler and slightly wetter start to August has steadied conditions and should help later-seeded crops meet yield expectations. The heat stress during July has caused crop development to accelerate, resulting in crops maturing ahead of historical timelines. Even with a cooler break, crop condition ratings continue to decline slightly from the previous week. Currently, 46 per cent of crops in Alberta are in good or excellent condition, compared to the five-year average of 56 per cent. Canada’s high quality milling wheat, Canadian Western Red Spring Wheat (CWRS) is a direct competitor for Australian milling grades into many Asian markets. A poor finish to the season could support Australian milling wheat demand going forward.

AUD

The Australian dollar is an important piece of the puzzle for Australian growers to be mindful of over the coming months with key central bank monetary policy meetings on the horizon. Foreign exchange markets throughout July and early August have been highly responsive to new data prints and reactive to risk sentiment.

In mid-July, the AUD showed signs of strength climbing toward US$0.68 before selling off to lows of 0.635 which hadn’t been seen since April. The sell off was data driven initially, with soft Consumer Price Index (CPI) and Non-Farm Payroll figures in the US, then an unwinding of risk allocation in Asia creating a whirlwind sell off in equities and FX. The dip in AUD was swiftly bought up returning to 0.66 within a couple of trading sessions.

The AUD trajectory throughout August will largely hinge on how the U.S. navigates softening economic data and the expectation of September rate cuts by the Fed.

With Australian interest rates expected to remain higher for an extended period as signalled in recent RBA minutes, the AUD should remain well supported with the caveat that global risk appetites are maintained and concerns of a US recession are eased. A steep increase in the AUD will dampen our export competitiveness in the global market.

Where to from here?

As usual, commodity markets are complex with multiple drivers in play. A smaller and lower-quality crop in the EU is a positive for Australian milling wheat. Additionally, the decline in the Canadian crop potential could gradually shift demand to Australian wheat next year. However, the broader economic environment will continue to impact the value of the AUD and the terms of trade this dictates. While all this plays out over the coming months, let’s hope for a kind finish for local crops this spring.